If you want to transfer your money internationally, Wise is one of the cheapest and best options. A specialised platform for international transfers, it offers some of the best exchange rates on the market. As well as being simple, the process is fast and will save you a lot of money. Here’s a detailed presentation of Wise, from how it works to transfer fees, including our experience and the opinions of other users… you’ll find out everything you need to know about money transfers. And to help you complete your online registration and make your first transfer, we also have provided a step-by-step Wise tutorial in the article below.

Table of Contents

How does Wise work?

Wise is an online payment operator that lets you transfer money abroad. In 80 countries and 53 different currencies. With this system, you can hold and spend money online or in shops, send and receive money, and withdraw money from anywhere in the world. All transactions are carried out at real rates, so there are no surcharges like with traditional banks.

Wise offers exchange rates very close to the market rate for many currencies. The principle is simple: you transfer funds from your bank account to the Wise account, and the platform then transfers them to your receiving account abroad. It works the same both ways.

Please note: the exchange rate applied to your transfer is actually that of the day on which the Wise platform carries out your transfer. So don’t take the daily rate into account when you register.

As well as being a transfer platform, Wise also offers a multi-currency debit card. This allows you to spend money worldwide with low conversion fees and no transaction fees. The card is only available to multi-currency account holders resident in certain countries (UK, USA, Australia, New Zealand, etc.). This type of account works with 6 different currencies: euros, pounds sterling, US dollars, Australian dollars, New Zealand dollars and Polish zloty.

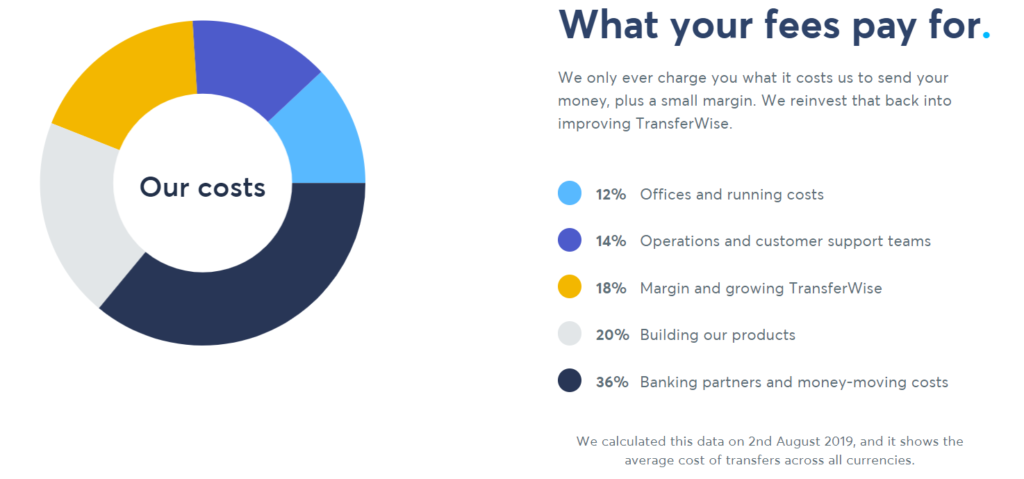

How much does Wise cost?

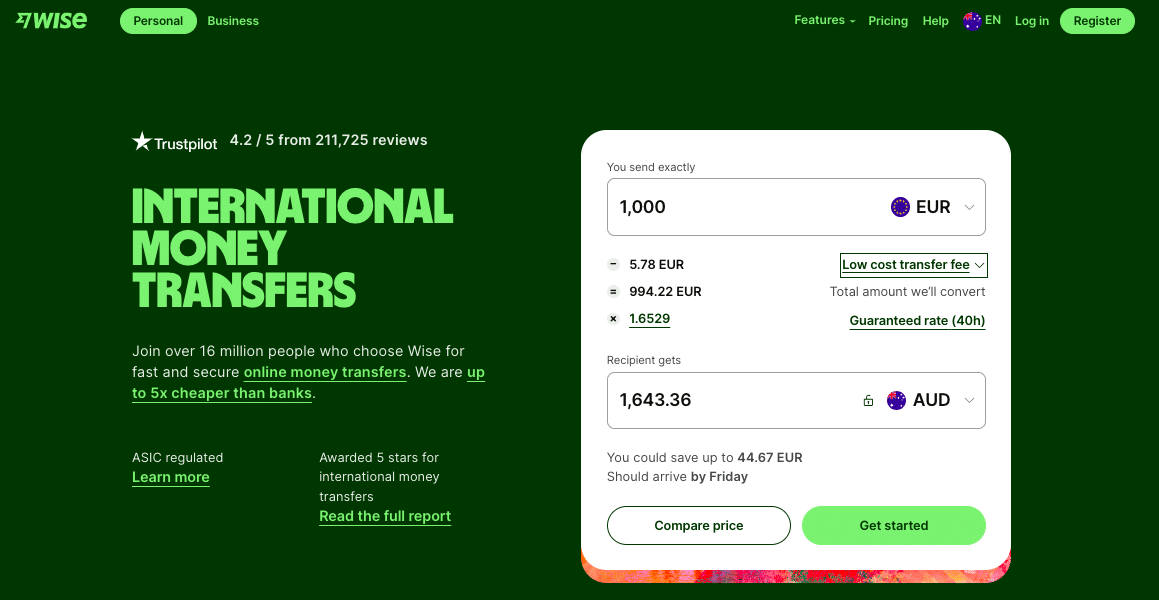

Unsurprisingly, as soon as you register, you know the exchange rate applied and the fees charged by Wise. A single and unique commission is applied to the transferred amount.

Wise offers two options to meet your money transfer needs to Australia:

Low cost transfer

You can choose the transfer formula at a low cost. It allows you to save as much as possible by bank transfer. The fixed transfer fee is €0.51 + 0.53% of the amount to be converted. Some payment methods may incur additional charges.

| Transfer amount | Costs | Total |

|---|---|---|

| 100€ | 0,51€ + 0,53% | 1.03€ |

| 500€ | 0,51€ + 0,53% | 3.14€ |

| 1000€ | 0,51€ + 0,53% | 5.78€ |

| 5000€ | 0,51€ + 0,53% | 26.87€ |

| 10 000€ | 0,51€ + 0,53% | 53.23€ |

| 50 000€ | 0,51€ + 0,53% | 264.11€ |

Fast transfer

The rapid transfer formula is designed so that you can transfer your money as quickly as possible with Wise. It works through your debit/credit card. This option is however slightly more expensive! The fixed charges are the same as for a low-cost transfer, i.e. €0.51 + 1% of the amount.

| Transfer amount | Costs | Total |

|---|---|---|

| 100€ | 0,51€ + 1% | 1.50€ |

| 200€ | 0,51€ + 1% | 2.50€ |

| 500€ | 0,51€ + 1% | 5.47€ |

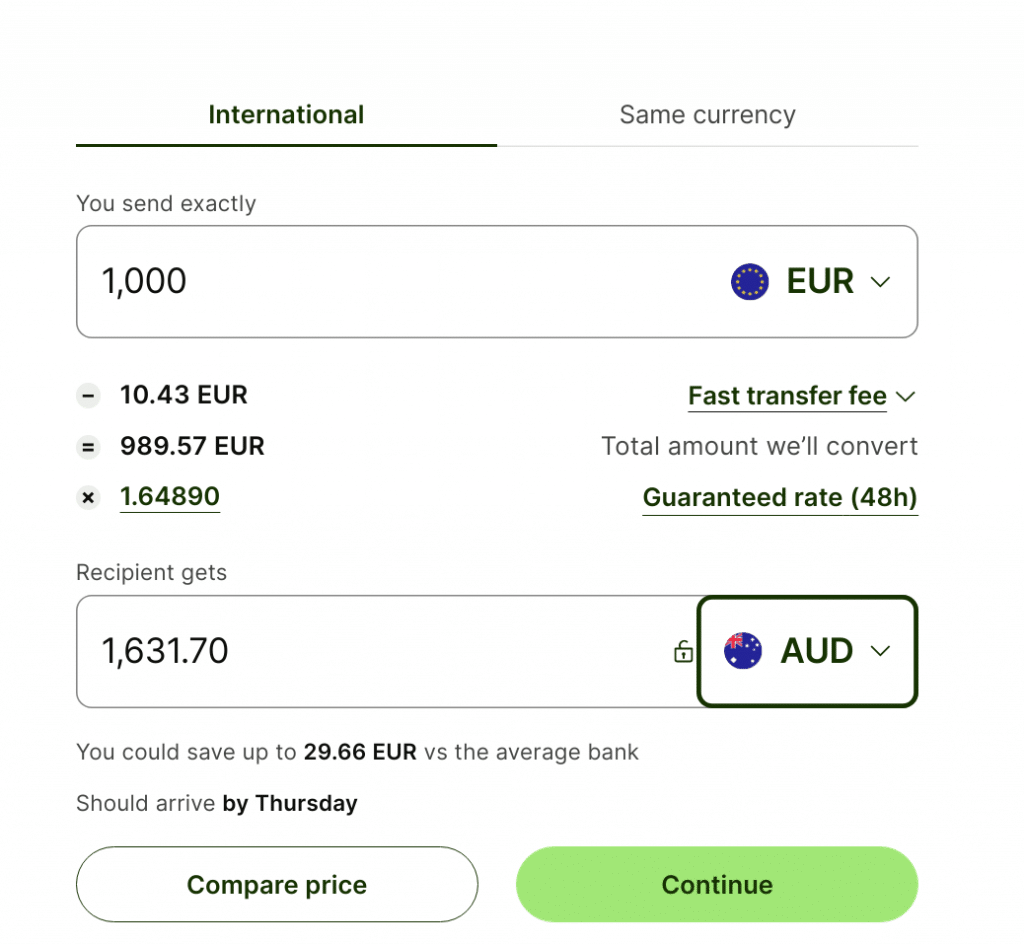

| 1000€ | 0,51€ + 1% | 10.43€ |

| 2000€ | 0,51€ + 1% | 20.36€ |

| 2500€ | 0,51€ + 1% | 25.33€ |

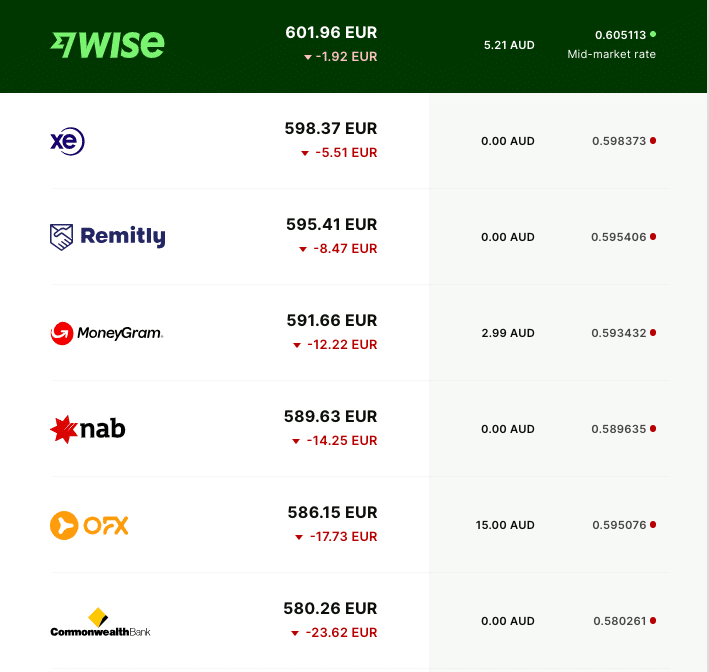

Comparison: Wise vs Banks

EUR to AUD transfer

Here is an example with the low cost formula:

| Wise | Traditional bank | |

| Transfer amount | 1000€ | 1000€ |

| Fees | 5,78€ (1st transfer free) | You don’t pay transfer fees (but often there are) |

| Proposed Rate | 1€ = 1,6529$ (market rate) | 1€ = 1,6529$ (market rate) 1.6344 AUD (rate offered by the bank) |

Amount transferred | $1,643.36 | Around $1,634.49 |

Of course, this is a simulation for information only. Money transfer fees vary by bank. On average, the fixed costs amount to 25€.

AUD transfer to EUR

For a transfer of $1000 on Wise:

The different transfer methods

We will see how to transfer Euros and Australian dollars.

Euros transfer (EUR)

Important – Info March 2024: PayPal is temporarily deactivated for EUR account customers due to technical problems. Wise informs its customers that there is no known date for the return of PayPal.

There are several ways of transferring your euros abroad:

- Payment by debit card.

- Payment by credit card.

- Payment by bank transfer.

- Payment by Sofort transfer.

By using the above methods to send your euros, you will be able to choose one of the following 3 different transfer modes. The mode you choose will depend on the amount you want to transfer from one account to another.

The most used transfer method is low-cost transfer because it is the cheapest and most convenient.

Low cost Transfer

This transfer method was set up for users who want to save as much money as possible. The small weak point, if it must be one, is the slowness of the payment. It is a little slower than the other transfer methods (quick and easy). This is because you have to send the money via a separate transaction.

To make a low-cost transfer, you can use one of the three methods available: bank transfer, use the money available in your balance or pay with iDeal, Trustly or SOFORT (if the sum exceeds €3,000). Wise doesn’t need to intervene to speed up the transaction, which is why the platform can offer its users transfers at better prices! Count €5.78 fees for a transfer of €1000.

Easy Transfer

This transfer method is only possible if you want to send 3000€ or less. Convenient and fast, Easy Transfer is only available in a few European countries (Austria, Belgium, Germany, Italy, Netherlands, Spain and Switzerland).

Easy transfers are made with the SOFORT by Klarna tool. This means payment is made using your bank details. Sofort is a popular online payment method in Europe that allows you to carry out transactions with almost any bank. You don’t need to create an account to use the platform, simply connect to your usual bank and authorise the transaction via an authentication number. Bank transfers with Sofort generally take between 0 and 4 working days. Count €6.93 fees for a transfer of €1000.

Fast Transfer

This type of transfer is the fastest way to send money abroad. All you have to do is enter your bank card details or use your fingerprint with Apple Pay/Google Pay. The problem is that it is also the most expensive. Your transfer will be made within 24 hours. Count €10.43 fees for a transfer of €1000. This payment method is only possible for Visa and MasterCard cards.

💡 Traveller Advice

If you need money quickly, plan your transfers at the start of the week. Banks are closed on weekends and you cannot receive money transfers. This can lengthen the transfer time.

Australian dollars (AUD) transfer

For transfers of Australian dollars there are 5 payment methods:

Bank transfer

You can make this transfer from your online bank by adding Wise as a beneficiary. For faster processing, you must indicate the payment reference in the reason for the transfer.

POLi

POLi is a payment system linked to your online bank. It is an alternative to the bank card and a more secure way to manage your payments online. POLi does not charge any additional fees if you use their service. However, the fees with Wise are higher. Check with your bank to find out if you can use this service. POLi payments can be made with the following banks: ANZ / Bank of Melbourne / Bank of Queensland / BankSA / Bankwest / Bendigo Bank / Citibank / Commonwealth Bank / IMB Building Society / ING Direct / NAB / Newcastle Permanent / People’s Choice Credit Union / St. George Bank / Suncorp / Westpac.

PayID

PayID is a simple transfer solution without having to use your account number and your BSB. This is very useful if you do not remember your bank details. A phone number, an email or your ABN is enough to make a transfer or have your money transferred. It is a simple solution especially since the fees are the same as a bank transfer. The transfer method with PayID is different. Here are the steps to follow:

- Configure your AUD transfer on Wise

- Choose the PayID payment option

- Log on to your online banking website or application

- Choose payment by email

- Transfer the amount to the address: aud@transferwise.com

- Enter the 15-digit number in the payment description field

The first transfer with PayID and Wise is longer because the bank has to carry out checks. The next transfers will be instant. To use this service check that your bank uses PayID.

Credit card & debit card

You can pay with Visa, MasterCard and Maestro cards which have a 16-digit card number. The principle is the same as an online payment and must respect the following conditions:

- The name on the card must match the name on your Wise account

- That the issuer has sufficient funds in his account

- Define a receiver (can be the same as the issuer)

- Enter the card number, expiration date and verification number

- Do the authentication test if your bank requires it

When paying with an international card, more charges will be applied. This is because processing these payments is more expensive. Additionally, the bank might also charge a fee to convert your money. If you pay in a currency of the European Economic Area, using your card issued in the EEA, you will not have to pay any fees.

The difference between credit and debit cards are the variable fees which are higher for the credit card.

Transferring money from your balance

Sending money from your Wise balance is faster than from an external bank account. In addition, for a transfer of more than £1,000 (or the equivalent in another currency), the applicable charges are lower! Obviously, to use this method, you need to have a balance or open one and make sure you have enough money to make your transfer.

There are two transfer methods. The first is to access your balance and send money directly from it. For the second, you can decide to create a transfer and choose to send the money from your balance from the payment stage. However, you should be aware that you won’t benefit from the lowest charges if you choose to send money using this second method.

Comparison: Wise vs. mobile banks

| WISE | REVOLUT | N26 | |

| Payments available in | 160 countries | 160 countries | Less than 160 |

| Currencies available | 40 | 36 | 36 |

| Multi-currencies account | Yes | Yes | Yes |

| Debit / credit card | Yes | Yes | Yes |

| Digital card | Yes | Yes | Yes |

| Apple Pay/Google Pay | Yes | Yes | Yes |

| Card fees | €7 | Free | Free |

| Invest in stocks | Yes | Yes | Soon |

| Youth account | No | Yes for -18 yo | No |

| Savings & interests | Yes | Yes | Yes |

| Business account | Yes | Yes | Yes |

| Reviews | 4,2/5 on Trustpilot 4,8/5 on Play Store | 4,2/5 on Trustpilot 4,7/5 on Play Store | 3,6/5 on Trustpilot 3,8/5 on Play Store |

Other Wise tools & services

Borderless Account

The Borderless Account is a new feature in Wise. Your multi-currency account allows you to hold and convert money in over 53 different currencies. You can also send money to over 80 countries.

This Wise feature is completely free. Once you have registered, you must activate the “Borderless account” function. You will need to verify your phone number using a code sent by SMS. This feature is very useful if you have to make transfers in several currencies ($, AUD $ or even £). The fixed fee for sending money is 0,41% (minimum) and increases depending on the currency. Note that once you have registered for a multi-currency account, you will receive a Wise MasterCard debit card (free of charge).

For more information on available currencies visit the Wise website.

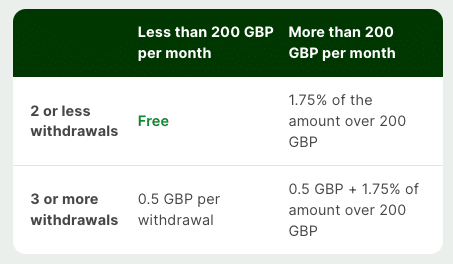

Wise Debit card

This card allows you to make purchases anywhere in the world at the real exchange rate. The conversion costs are very low and there are no transaction costs. Beware that fees may be applied for certain ATM withdrawals.

To obtain the Wise bank card you must pay €7 (a little over $10). These fees cover the creation of the card, verification of your identity, customer service and delivery costs. In addition, you will not have any monthly management fees or any other fees to pay.

Visit the website to view the conversion fees when using the card.

Email alerts on best rates

An email alert to obtain the best rates is also available to allow you to benefit from the best rates for your transfer.

Invest in stocks

You can choose to put your money to work on the stock market and invest it in one (or more) of the 1500 largest companies in the world such as Apple, Google or Tesla. On average, the funds have grown 13.39% per year since 2012. That said, the future growth of your investments is by no means guaranteed. Funds are in EUR and returns may vary by currency.

Earning ‘Interest’

Wise has launched a new feature called ‘Interest’. This is a new way for Wise customers to safeguard their money and grow it at the same time. The money is placed in a fund that tracks the interest rates of central banks, meaning that when their rates change, yours do too.

These assets are guaranteed by the British and European governments and allow the user to generate a return (3.19% in euros and 4.82% in pounds sterling). It is important to know that all of your money remains available for your daily expenses. ‘Interest’ gives Wise customers the opportunity to transfer their cash balance into interest-bearing assets. These assets then follow the interest rate of the central banks.

Capital at risk, the current rate does not guarantee future growth.

Tutorial for your First Transfer with Wise

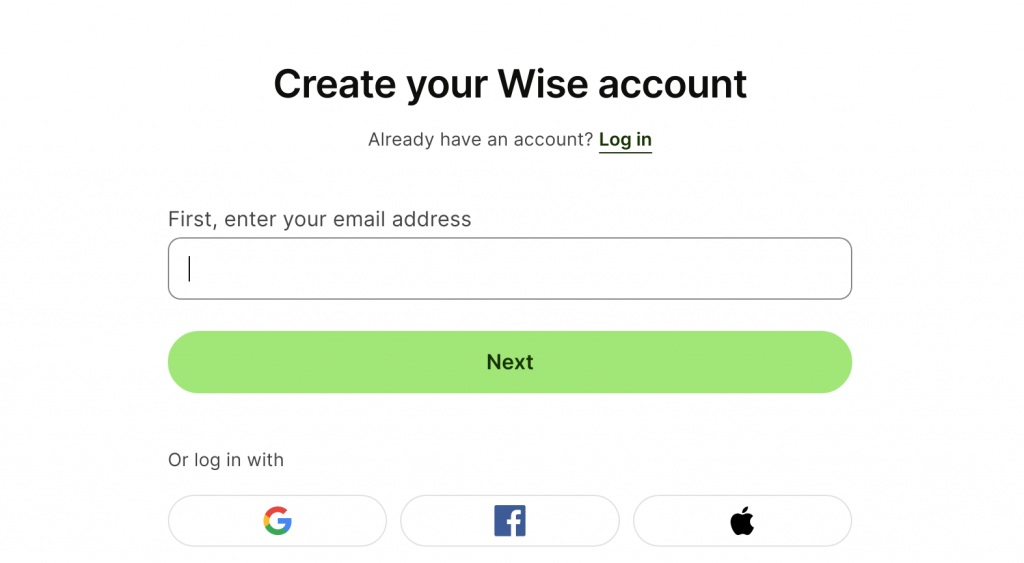

Step 1: Create an account

Start creating your account by clicking here.

Once you’re on the Wise homepage, click “Open an account”.

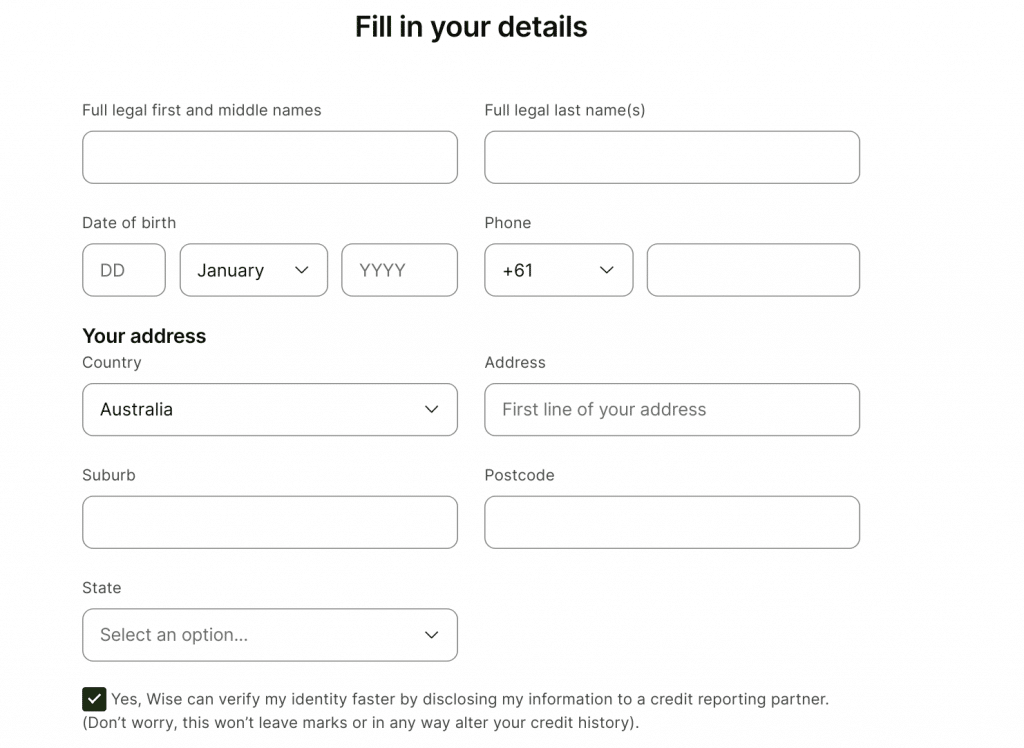

Follow the steps to create your account by entering your email address.

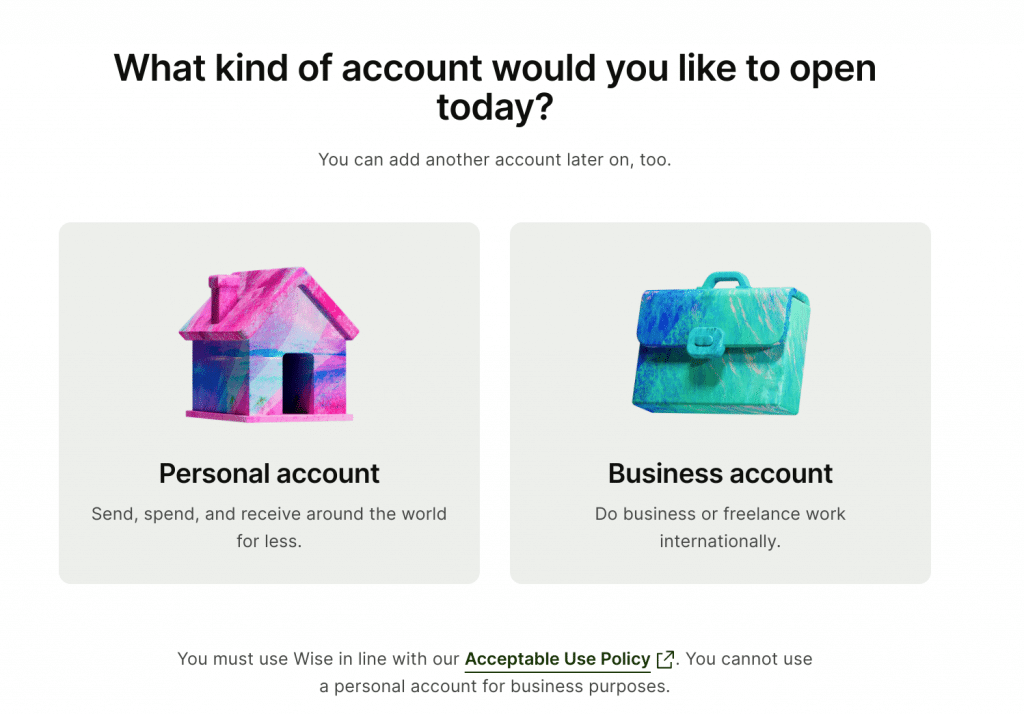

You will have to choose if you want a personal account or a business account.

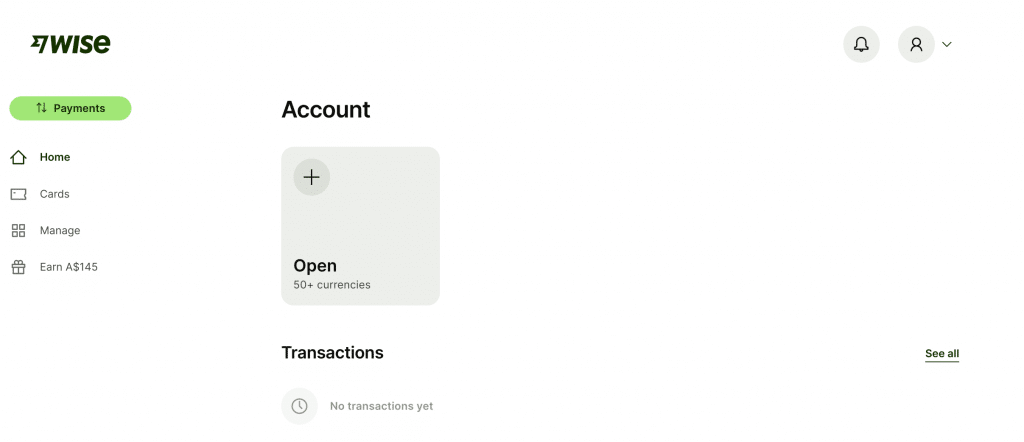

You will then have to verify your phone number with a code and then choose a password.

Once your account is created, click on “Send Money” under the “Payments” tab at the top left of the page to begin your transfer.

Step 2: Set up your money transfer

You are now ready to transfer your money. On this screen, enter:

- The amount you want to transfer

- The original currency and the currency of the converted amount (€/$)

- Also select the desired transfer type:

Easy and fast transfer (faster but more expensive)

Low cost transfer (cheaper but slower) – We recommend this option.

- You will then get:

- The amount converted into the desired currency

- Reminder of transfer fees as well as the exchange rate applied

- The amount you will save compared to a classic transfer through your bank

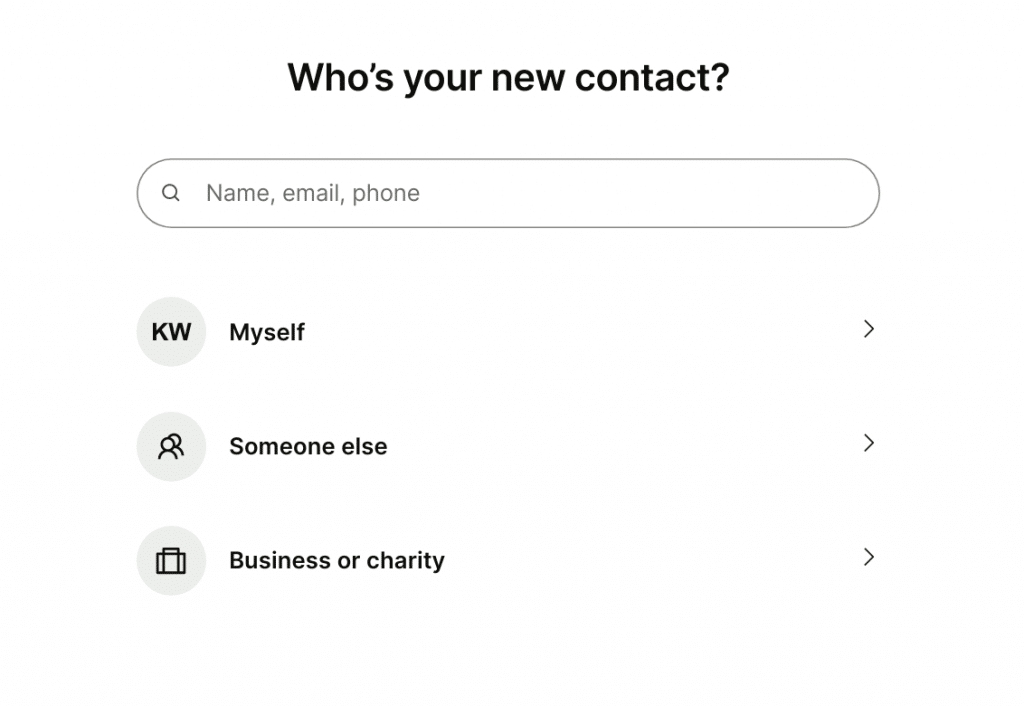

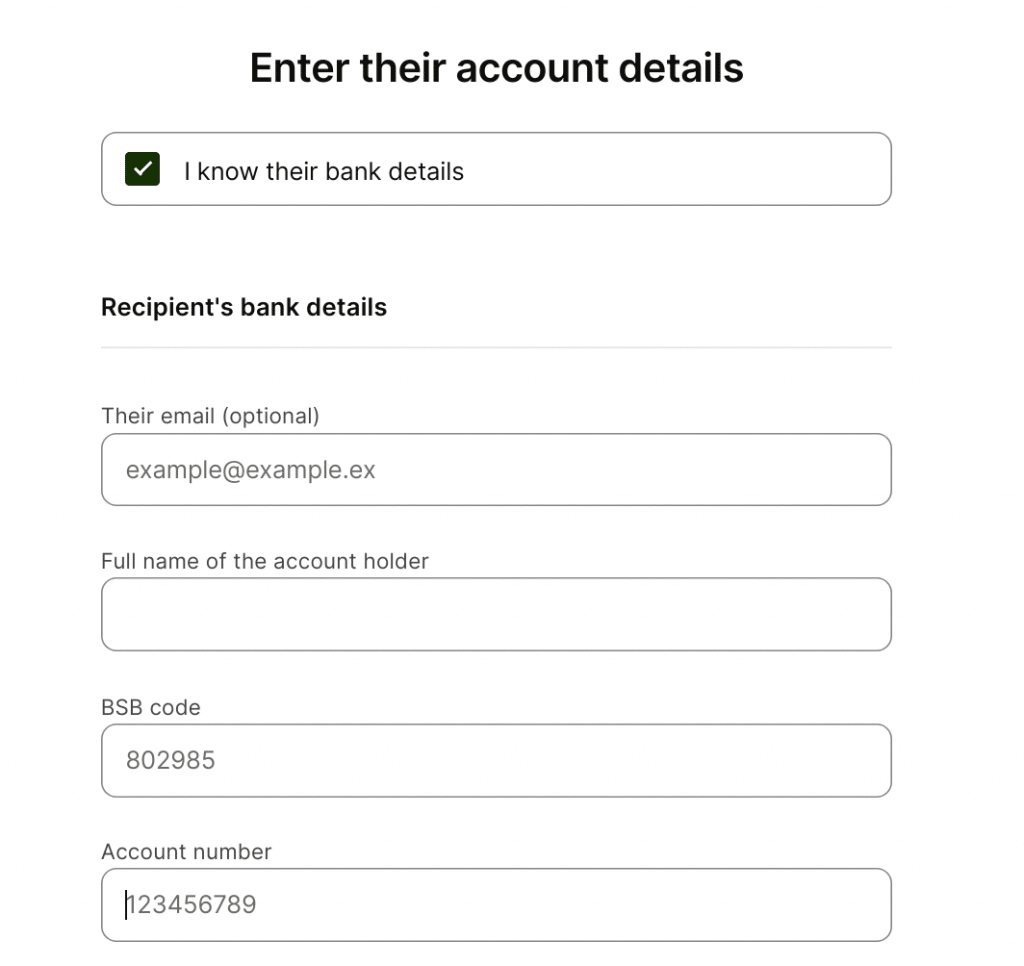

Click “continue”. You will then have to fill in all of your contact details. On the next page, you will have to choose whether you want to make a transfer to yourself or someone else. You will have to add your transfer recipient as a new contact.

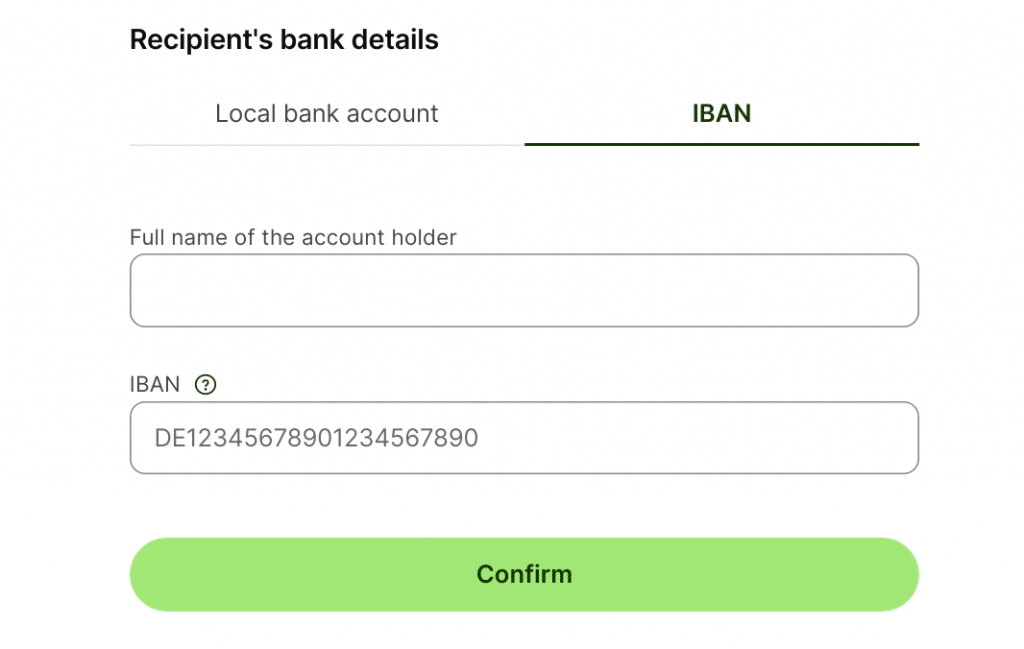

Then fill in your bank details:

- Name of bank account owner

- BSB code: BSB number (equivalent to SWIFT code in Australia)

- Account number

Note: Depending on the country, this information may be different. In Ireland, for example, you will be asked for your IBAN.

Click “Confirm”.

Step 3: Confirm transfer

The next page is a summary of the transfer you wish to make.

You can add a reference to your transfer. That way, when you look back on the transfer you will remember what it was for etc.

Once the information is verified, click “Confirm and continue”.

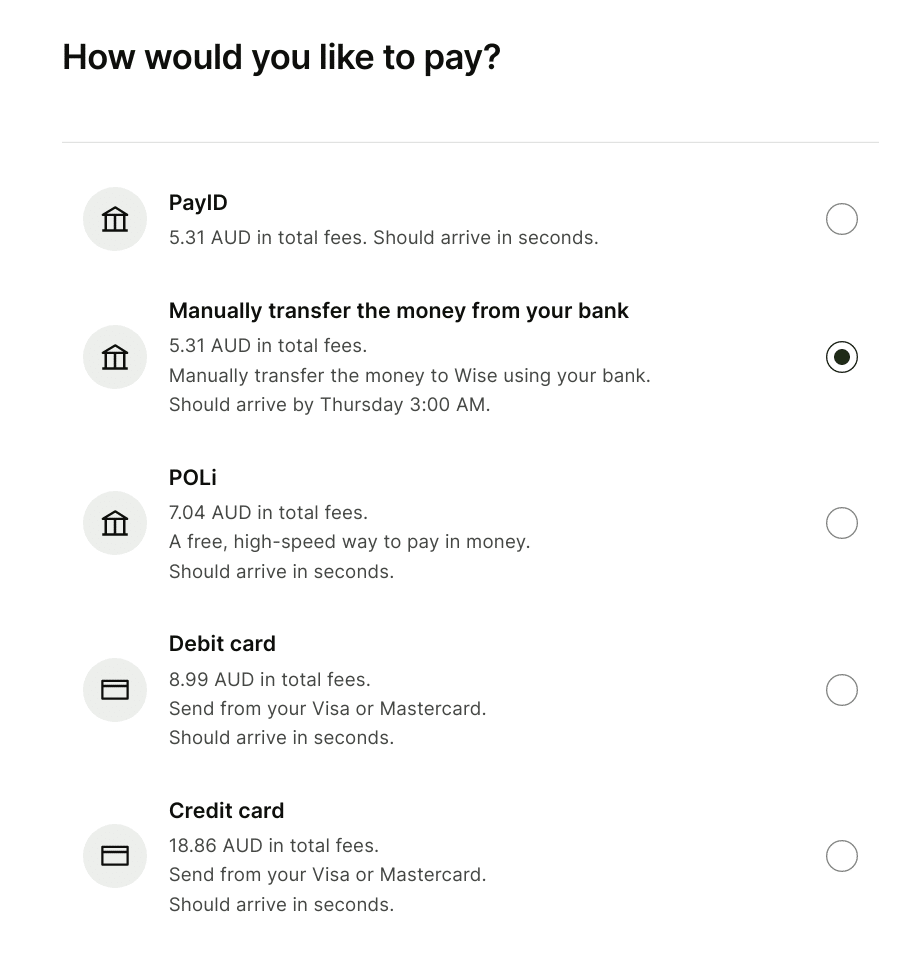

You can then choose your preferred method of payment and click “continue to payment”.

NB: We recommend wire transfers to avoid paying additional fees.

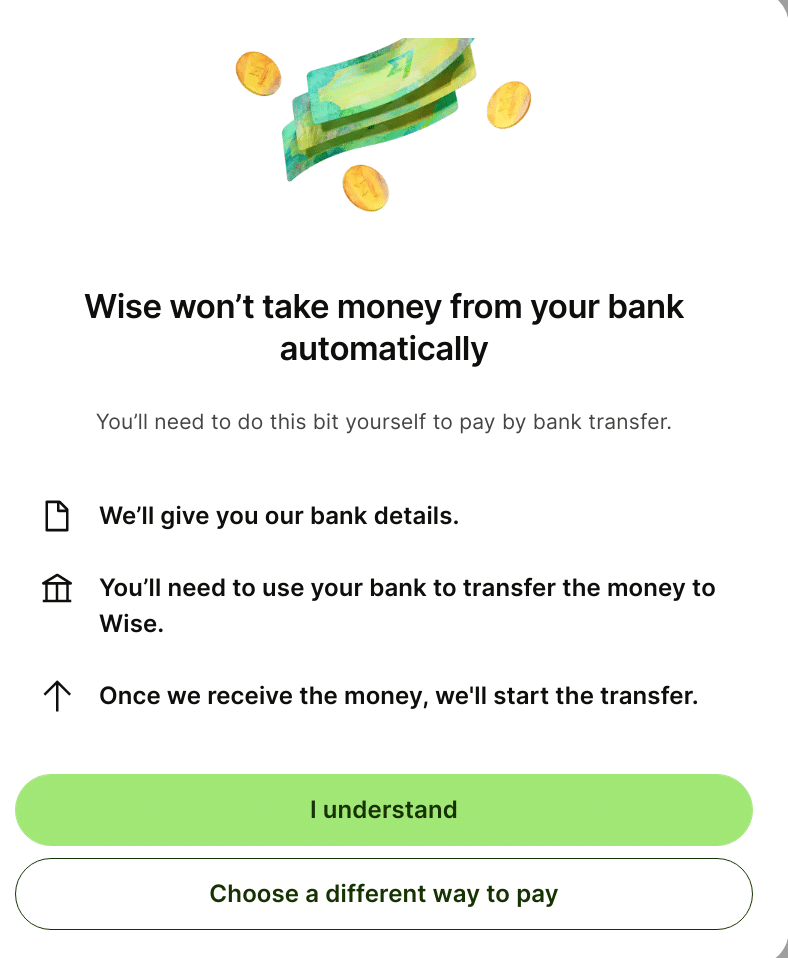

A pop-up window will then appear. Read the content and click on “I understand”

Step 4: Send the funds by bank transfer

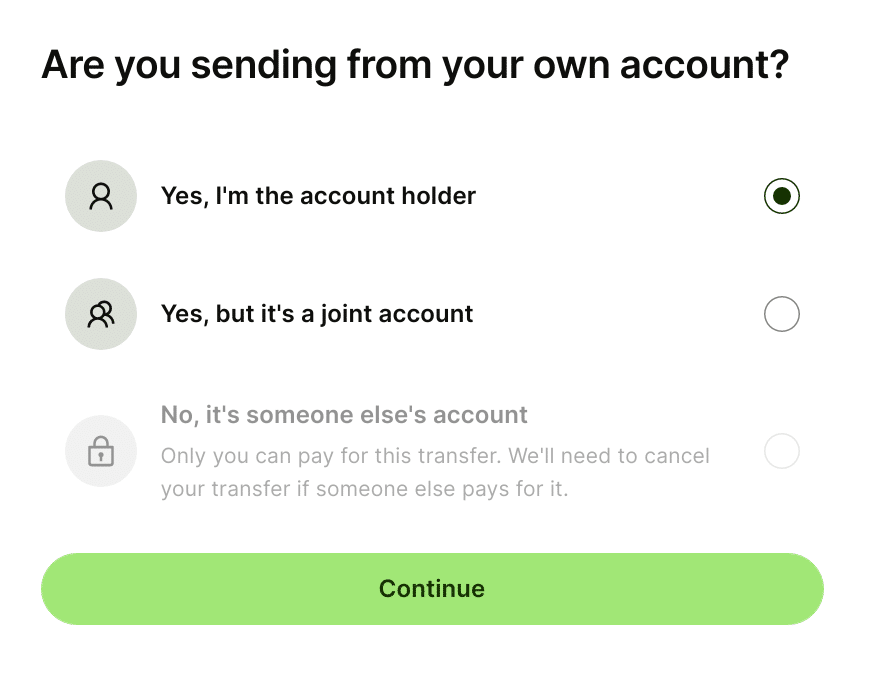

You will then need to confirm whether you are sending money from your own account or from a joint account. Choose the option that applies to your situation.

Generally, the bank transfer will be made using online banking.

Wise will then provide their bank details so you can make the transfer to them. Wise will not automatically withdraw money from your bank account.

1 – Click “Pay now” and select your bank to be brought to their website so you can access your online bank account. Enter Wise’s account information. Wise will then transfer the funds to your account abroad. Depending on the bank, adding a beneficiary can take 1 to 3 business days.

2 – Once the Wise account has been added as a beneficiary, make a transfer of the amount provided to this account. Remember to enter a reference for your transfer. Allow at least 48 hours for the money to be paid into your home account after sending the funds.

3 – Click on “I’ve paid“.

💡 Another alternative

You can also make a transfer via credit card payment (Visa or Mastercard only). For large amounts of money, your bank may not authorise payment. You will be informed of this during the verification stage. You can contact your bank to give permission for the transfer to take place.

Step 5: Wait for the transfer to be received

Wise will send you an email confirming receipt of your transfer. They will then make the conversion into the desired currency and automatically transfer the funds to the specified receiving account. You will receive a second email telling you that the transfer is in progress, with the confirmed amount and a provisional date of arrival.

Travellers’ advice

Allow an average of 5 working days for your first transfer (except in the case of rapid transfer). Subsequent transfers typically take 3 business days.

Why Choose Wise?

Wise is a British company accredited by the financial authorities. They offer international money transfers for minimal fees. Their services are increasingly popular, especially amongst young people on Working Holiday Visas in Australia, and provide a very easy-to-use platform. A secure and world-renowned platform, their transfers are fast and safe.

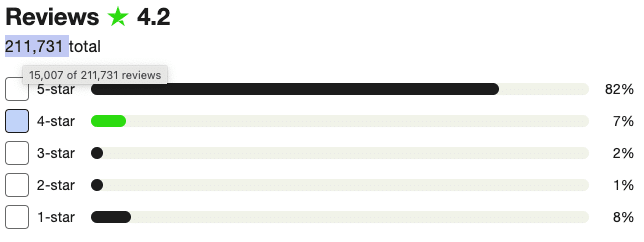

Rating on TrustPilot

Wise has also received a rating of 4.2/5 on TrustPilot with 211,731 reviews.

Wise User Reviews & Comments

In general, the opinions on Transferwise are positive. The main benefits of, according to user feedback, are:

- The simplicity of usage,

- The speed of transfers,

- Low fees compared to banks and other competitors.

Wise has the advantage of offering an application available on Android and iOS. This allows you to make your transfers easily and follow your money step by step.

In terms of negatives, it seems that some transfers took longer than expected for some users, and other people did not like the interface. Identity verification may take a while to set up your account.

Our experience with Wise

The Wise user interface is very ergonomic and registration is quick and easy. We have already used their services many times. Once your account is created and the first transfer is made, the procedures are even faster. In just a few clicks you can transfer your money with TransferWise.

There are several methods to transfer money with Wise. Online payment by credit card and bank transfer. However, payment by card may be limited by the ceiling authorized by your bank.

How long does a transfer take?

In terms of time to make your first transfer, there are three parameters to take into account:

1 – The time imposed by your bank to add a beneficiary for your transfers (vary from 24 to 72 hours)

2 – The time required to make your transfer with your bank. In general 1 working day, so if you make the transfer on weekends you will have to wait for Monday.

3 – The time required to make the transfer by Wise to your account. In general 1 working day, so if you make the transfer on weekends you will have to wait for Monday.

As an example when we made our first transfer:

- Monday: We signed up and added Wise as a beneficiary to our bank the same day.

- Wednesday: We were able to transfer to the Wise account.

- Thursday: Wise informed us of the receipt of our transfer and a few hours later we received an email from them to inform us that the transfer was underway.

- Friday: The money was in our Australian account.

So it took us 5 days for our first transfer. Next transfers took approximately 2 business days.

History of Wise

Wise is a company launched since January 2010. It has its head office in London and has 14 offices around the world. With more than 10 million customers worldwide today, this platform transfers more than $6 billion every month!

Historically the company was created by two Estonians who worked at Skype. As they were both working abroad, they soon encountered the problems of transferring money internationally. At the time, they transferred their money through their bank, but the process was often complicated. In addition, they regularly lost money on the exchange rates and bank charges that were applied. They then decided to remedy all this by creating a new concept!

In terms of security, by the nature of its activity, TransferWise is highly regulated. The company is accredited by the British Financial Conduct Authority. For each country where it is present, the company is registered with the competent authorities. The transfers, therefore, meet all the security and anonymity criteria allowing you to transfer your funds with confidence.

The principles of Wise

Transparency

Transparency about fees and profits.

Lower charges

Costs reduced as much as possible.

Premium Service

Premium service.

FAQ Wise

How long does a transfer take?

Is it possible to cancel a transfer?

Follow the steps below to proceed with the cancellation:

- Go to the Activity section of your account

- Find the current transfer you want to cancel

- Click on Cancel Transfer (on Android you can access it from the 3 dots in the right corner of the transfer page)

- If you haven’t paid yet click on I haven’t paid then on Cancel transfer

- If you have already paid click on I have paid and enter your bank details if necessary

You do not need to provide your bank details if you have made a credit transfer. In this case the amount will be directly refunded to your card.

What happens if there is an error on the beneficiary account?

Is Transferwise reliable?

How are Wise fees determined?

Is it possible to have multiple accounts?

What documents do I need to provide to open a multi-currency account?

What to do in case of fraud?

Which currencies are supported?

- Euro (EUR)

- Dollar: American (USD), Australian (AUD), New Zealand (NZD), Canadian (CAD), Hong Kong (HKD), Singapore (SGD)

- Book serting (GBP)

- Crown: Czech (CZK), Danish (DKK), Norwegian (NOK), Swedish (SEK)

- Indian Rupee (INR)

- Emirati Dirham (AED) (local and international reception) (only sent to UAE)

- Bulgarian Lev (BGN)

- Brazilian Real (BRL) (only individuals)

- Swiss franc (CHF)

- Croatian Kuna (HRK)

- Hungarian Forint (HUF)

- Japanese Yen (JPY)

- Malaysian Ringgit (MYR)

- Polish Zloty

- Romanian Leu (RON)

- Turkish lira (TRY)

Sending euros with Wise is made to SEPA-compliant bank accounts in the SEPA area and to bank accounts denominated in euros with an IBAN outside the SEPA area. It is also possible to receive euros via SWIFT from outside the SEPA zone. You can only transfer money to these currencies (local bank transfer):

- Peso: Argentinian (ARS), Colombian (COP), Mexican (MXN), Filipino (PHP), Uruguayan (UYS)

- Bangladeshi Taka (BDT)

- Botswana Pula (BWP)

- Chilean Peso (CLP)

- Chinese Yuan (CNY) (limited transfer currency)

- Costa Rican Colon (CRC)

- Egyptian Pound (EGP)

- Georgian Lari (GEL)

- Ghanaian Cedi (GHS)

- Rupee: Indonesian (IDR), Sri Lankan (LKR), Nepalese (NPR), Pakistani (PKR), Ugandan (UGX)

- Israeli Shekel (ILS)

- Shilling: Kenyan (KES), Tanzanian (TZS)

- South Korean Won (KRW)

- Moroccan Dirham (MAD)

- Nigerian Naira (NGN)

- Peruvian soil (PEN)

- Russian Ruble (RUB) (Except Sevastopol and Crimea)

- Thai Bath (THB)

- Ukrainian Hryvna (UAH)

- Vietnamese Dong (VND) (Only for individuals)

- West African CFA Franc (XOF) (Benin, Burkina Faso, Côte d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal and Togo)

- South African Rand (ZAR) (Only with SWIFT network and by local transfer)

- Zambian Kwacha (ZMW)

For more details on the conditions of use of currencies go to Wise site.

In which countries can you send money?

How to cancel or replace my Wise card?

On iOS: go to “Account”, then to “Manage card” and finally, select “Replace card” then one of the options on the screen.

On Android: Click on the ‘Account’ tab, scroll down to ‘Replace card’ and click on it. On the website: click on “Cards” on the left then select “Replace card” then one of the options on the screen.

Here are the 4 options that will be displayed: I lost my card, my card was stolen, my card is damaged and customer service suggested it to me. If you choose “I lost my card” or “My card was stolen”: your card will therefore be blocked and cancelled, you will only have to order a new one. If your card is damaged or customer service has advised you to replace it, you can continue to use the current card until the new one is activated. Count a delay ranging from 2 days to 3 weeks depending on the country in which you reside.