If you’ve made purchases during your stay, you may be eligible for a full refund on the 10% GST (goods and services tax) through the Tourist Refund Scheme (TRS). To qualify, you must take the goods with you when departing and present them at the airport TRS counter.

Refunds can be claimed at major international airports including Sydney, Melbourne, Brisbane, and Perth. This guide walks you through the step-by-step process to ensure you get your money back before leaving Australia!

Table of Contents

What is the Goods and Services Tax (GST) ?

In the UK, VAT (Value Added Tax) applies to all products and services purchased. The rate of VAT is variable, but 20% is the most common rate for purchases in the country.

The Australian GST is its equivalent. The rate is 10% of the price of the product or service. It applies to all goods and services purchased in Australia. For example, if you buy a $1,000 camera, you will pay $100 in tax.

If you are a tourist and therefore do not live in Australia permanently, you can request a refund of this tax when you leave the country. The TRS allows travelers to claim a refund of the GST (10%) paid on goods bought in Australia within 60 days before departure. This scheme is applicable only to goods that are taken out of Australia in the traveler’s personal luggage or carry-on.

Read also : GST in Australia – How it works

Conditions to Get your GST Back

✅ 01 – Purchase Within 60 Days

The goods must have been bought in person within 60 days before your departure.

✅ 02 – Minimum Spend of $300

The total cost must be at least $300 from one retailer.

Multiple items are allowed, but they must be purchased from the same store.

If bought on separate invoices from the same business, they can still qualify.

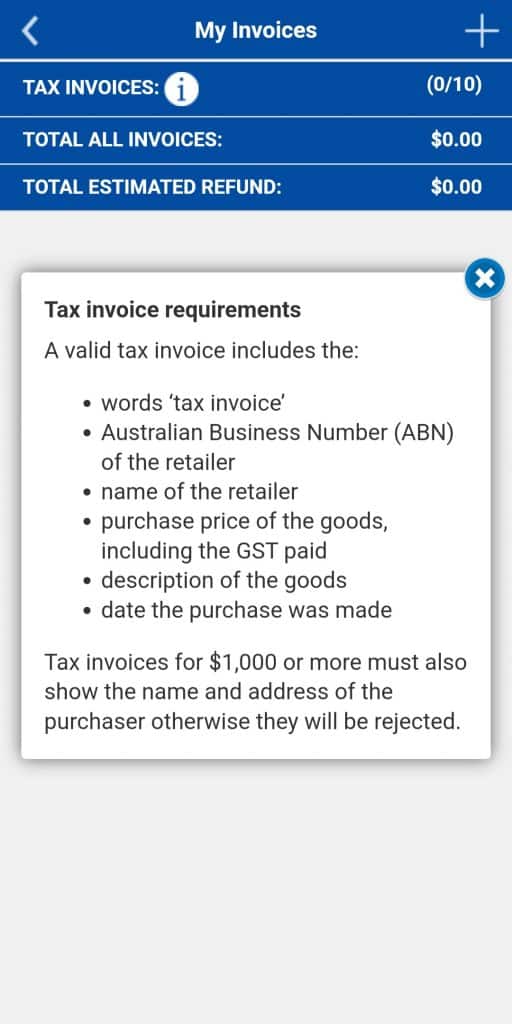

✅ 03 – Original Tax Invoice Required

You must present a paper tax invoice (print out any electronic invoices). If you have an electronic invoice, remember to print it out before you go to the TRS counter. The invoice must include the shop’s Australian Business Number (ABN), the date of purchase, the description of the goods and the amount of GST paid. If you do not have an eligible tax invoice, you cannot make a claim. Present the original tax invoice, goods, passport, and boarding pass to the TRS facility.

✅ 04 – Carry-On Luggage Requirement

You need to have the goods with you in your carry-on luggage when flying out of Australia. For oversized and restricted goods, they must be seen by ABF Client services before checking in and you will have to take the stamped invoices to the TRS Facility on departure day.

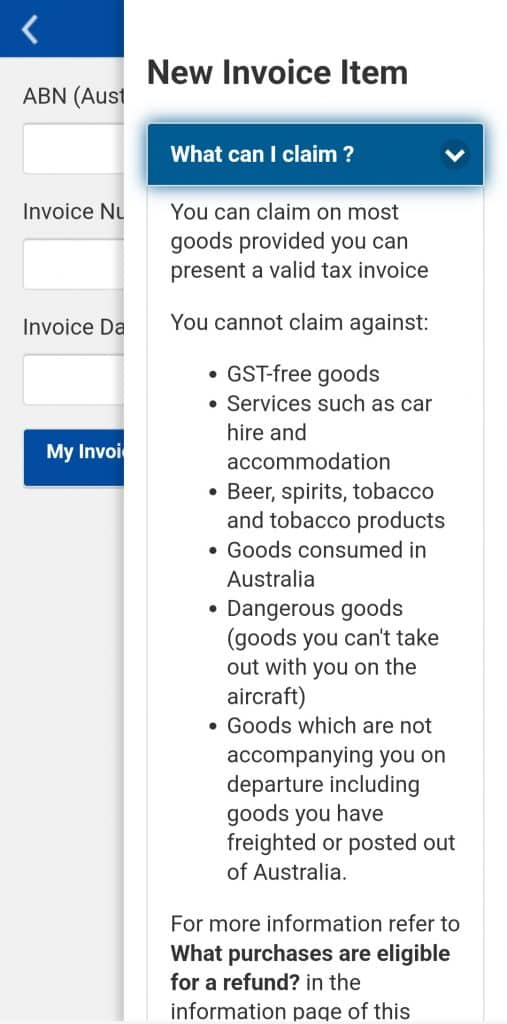

You cannot claim a refund on these goods:

- Tobacco products

- Alcohol except wine with alcohol content less than 22%

- Goods purchased over the internet and imported into Australia

- Services (hotel rooms, car rentals, tours, etc)

- GST-free goods where no GST was paid

- Goods prohibited on aircraft for safety reasons (gas cylinders, fireworks, aerosol etc)

- Products which have already been partially consumed, such as food and drinks or an open bottle of perfume. (However, you can claim GST on devices such as a laptop, camera or iPhone which have been used during your stay.)

💡 Good to know

You can remove your goods from the packaging and use them. You do not need to bring the packaging to make your TRS claim.

Claiming Your GST Refund

1. Keep Your Receipts: Save all tax invoices for purchases over AUD 300 from a single retailer, as you’ll need these for your claim.

2. Pack Smart: Ensure that the goods you’re claiming a refund on are easily accessible in your carry-on luggage, as you may need to show them at the TRS counter.

3. Early Arrival: Arrive at the airport with enough time to process your TRS claim before your flight. The TRS counters can be found in the international terminals of Australian airports.

4. Use the TRS App: The Australian Border Force (ABF) offers a TRS app that allows you to enter your claim details before reaching the airport. This can save time and streamline the process at the TRS counter.

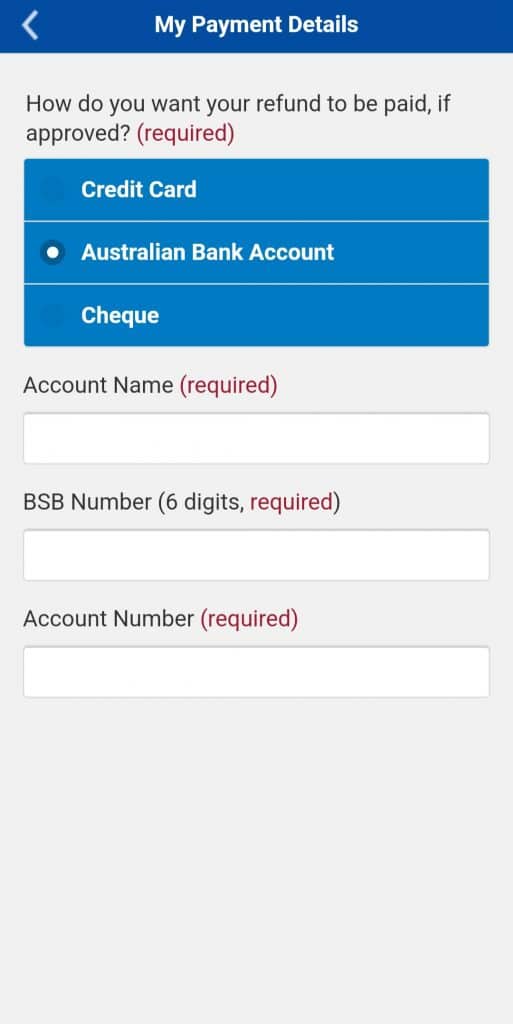

The refund can be paid into an Australian bank account, to a credit card, or by cheque. The refund will be made within 60 days of the claim being lodged.

You will need to present:

– The goods

– Your passport

– The invoices

– Your boarding pass

💡 Good to know

Although the TRS counters at airports don’t have fixed opening hours, they are open when an international flight is scheduled to depart.

Processing Your Refund

Once at the TRS counter, present your completed TRS claim (either via the app or on a provided form), along with the necessary documents and purchased goods. The refund can be paid into an Australian bank account, credited to an Australian credit card, or received by cheque. Some locations may offer immediate refunds to credit cards.

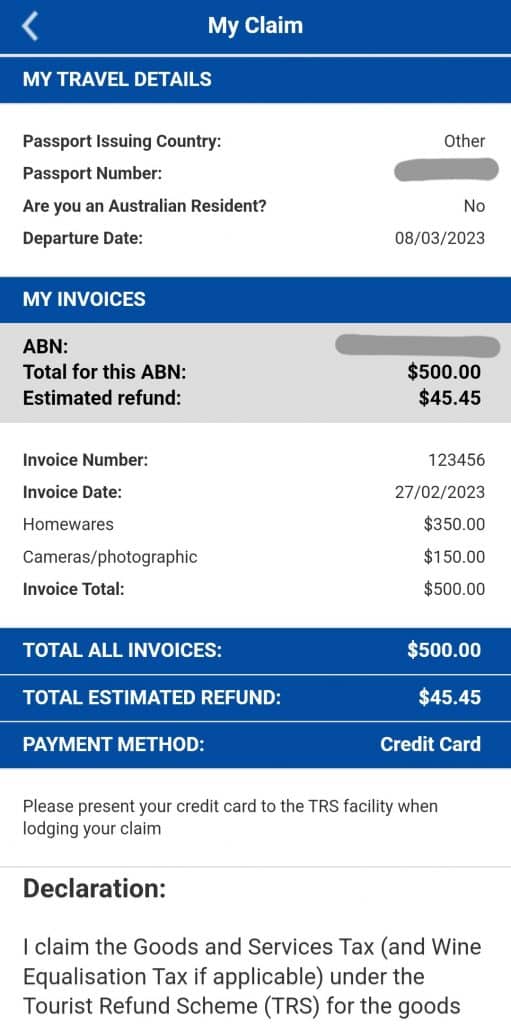

Speed Up Your GST Refund with the TRS App

To save time at the airport, use the Tourist Refund Scheme (TRS) app to pre-register your details and upload receipts before your flight. This helps streamline the process so you can get your GST refund faster.

✅ How it works:

1️⃣ Register your personal details and purchases in the app.

2️⃣ Head to the TRS desk in the Duty-Free area at the airport.

3️⃣ Present your boarding pass, goods, and original receipts to claim your refund.

🚨 Important: The TRS app is only supported at select airports, including:

✈️ Sydney, Gold Coast, Sunshine Coast, Brisbane, Townsville, Cairns, Darwin, Melbourne, Adelaide, and Perth.

How does the app work?

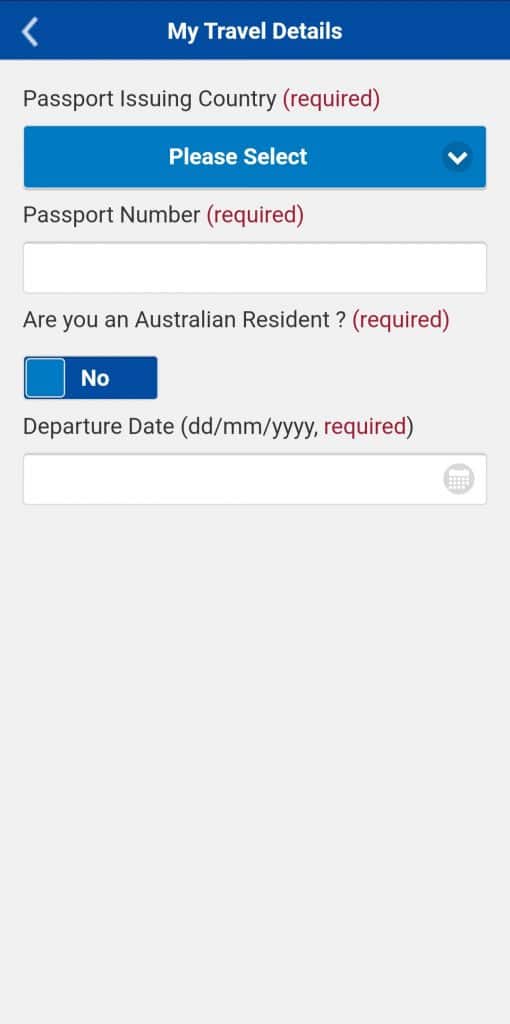

After downloading the app, type in the following:

- Details of your trip

- Details of the goods and invoices

- Preferred way to receive your refund

After saving the information, you will receive a Quick Response (QR) code that you can find in the “Present My Claim” section of the app. Once at the airport, you will need to present at the TRS counter. You will still need to attend a TRS facility with your tax invoice. This does not submit your claim.

Online statements are available at the following international airports: Adelaide, Brisbane, Cairns, Canberra, Darwin, Gold Coast, Melbourne, Perth, and Sydney.

Bringing Duty-Free Goods Back to Australia

If you return to Australia with goods for which you claimed a Tourist Refund Scheme (TRS) refund, you can bring in up to AUD 900 worth of items duty and GST-free.

✅ Passenger Concession Limits:

- Adults: Up to AUD 900

- Minors (under 18): Up to AUD 450

- Families traveling together can combine their allowances (e.g., a couple can bring in AUD 1,800 worth of goods duty-free).

🚨 If your total exceeds AUD 900:

❗ You must declare the goods.

❗ You will need to repay the GST refund on the claimed items.

❗ Customs duties and GST will apply to the entire purchase value, not just the amount exceeding AUD 900.

Make sure to check Australian Border Force regulations before arriving to avoid unexpected fees!

Tips for a Smooth TRS Experience

- Bulky Goods: For items that are too large to carry as hand luggage, you can show your goods to a TRS officer at the check-in area or customs before checking in the items.

- Group Claims: Families or groups traveling together can combine receipts to meet the minimum spend requirement but must present the claim together at the TRS counter.

- Exclusions: Note that some goods, such as consumables fully or partly consumed in Australia, are not eligible for a GST refund.

Contact info

If you need to contact the Tourist Refund Office (TRO) for a specific question, you can call them:

☎️ From within Australia: 1300 555 043

☎️ From outside Australia: +61 2 6245 5499.

You can also contact the TRO via email trs@abf.gov.au or their enquiry form.

FAQ

Yes, it must be the same as the name on your passport. You can’t claim a refund if the invoice has a name other than your own as the buyer.

Yes, you should be able to, as long as you respect the conditions mentioned above. Note that if you are bringing goods back into Australia for which you have claimed a TRS refund, you can only bring up to AUD900 worth of goods without having to pay customs duties or GST.

No, you can make several purchases over several days. If you have bought items from the same retailer but at different stores, check that each invoice has the same Australian Business Number (ABN). The same business might have different ABNs for each store.

No, you must do it at the TRS desk at your airport of departure at least 30 minutes before your flight.

You cannot get a cash refund for your GST. You can only get refunds paid to you or another person by credit card (Amex, Diners, JCB, MasterCard, Union Pay, Visa), Australian bank account or mailed cheque (not recommended).

hello. is there a maximum cap limit to claim tax refund for local residents leaving Australia?

Hi Becca, could you please clarify?

Hi, Can I claim GST for a handbag costing AUD$4200 and later bring it back after my trip, do I have to pay back the GST amount? Thank you

Hi Carly,

Please check the part “Coming back to Australia with de-taxed goods” and you will have your answer 😉

Cheers