If you plan to work in Australia, you have two options: be employed by a company, or be self-employed. If you are self-employed, you will need to apply for an Australian Business Number (ABN), which is quite a simple process. Here we explain what an ABN is, and how to get one.

Table of Contents

What is an ABN and what is it used for?

An ABN (Australian Business Number) is a unique 11-digit identification number assigned to businesses and self-employed individuals in Australia. It is used for tax and business transactions, allowing companies and freelancers to be officially recognized by the Australian government.

If you plan to work as a freelancer or independent contractor, you must apply for an ABN. This number enables your clients to identify you as a supplier and process payments for your services. It is also essential for correspondence with the Australian Taxation Office (ATO).

🔹 ABN vs TFN – What’s the Difference?

While a Tax File Number (TFN) is required for all individuals working in Australia, an ABN is necessary for those who work independently and operate as sole traders. Having an ABN allows you to issue invoices, claim tax deductions, and avoid higher withholding tax rates.

How to Start Freelancing in Australia

To determine if your activity is an activity requiring the creation of an ABN, it must have the following characteristics:

- It must be commercial, you must sell products or services

- You must intend to make a profit from this activity – unlike a hobby

- The activity must be repeated regularly and be organised in a professional manner

- You must have the relevant knowledge or skills.

In other words, you can apply for an ABN to work as a consultant, web designer, graphic designer, gardener, cleaner, driver, teacher, etc. when you have several clients to whom you sell your services.

It is important to note that if you are self-employed or running a business in Australia, you need an ABN to be in good standing with Australian tax requirements. Without an ABN, you could be subject to higher withholding taxes and tax penalties.

ABN or Employee? Beware of Sham Contracts! 🚨

If a company offers you a job but asks you to get an ABN, be cautious!

🔴 It is illegal for employers to classify regular employees as independent contractors. Some businesses do this to cut costs by avoiding tax payments and superannuation contributions.

As an employee, you are entitled to:

✔️ Paid leave

✔️ Superannuation contributions

✔️ Employer-covered taxes

If an employer insists that you must work under an ABN, it could be a sham contract – a tactic to deny you employee rights. Always verify your work status before agreeing.

💡 Tip: If you’re unsure whether you should get an ABN, check with the Australian Taxation Office (ATO) or a tax professional.

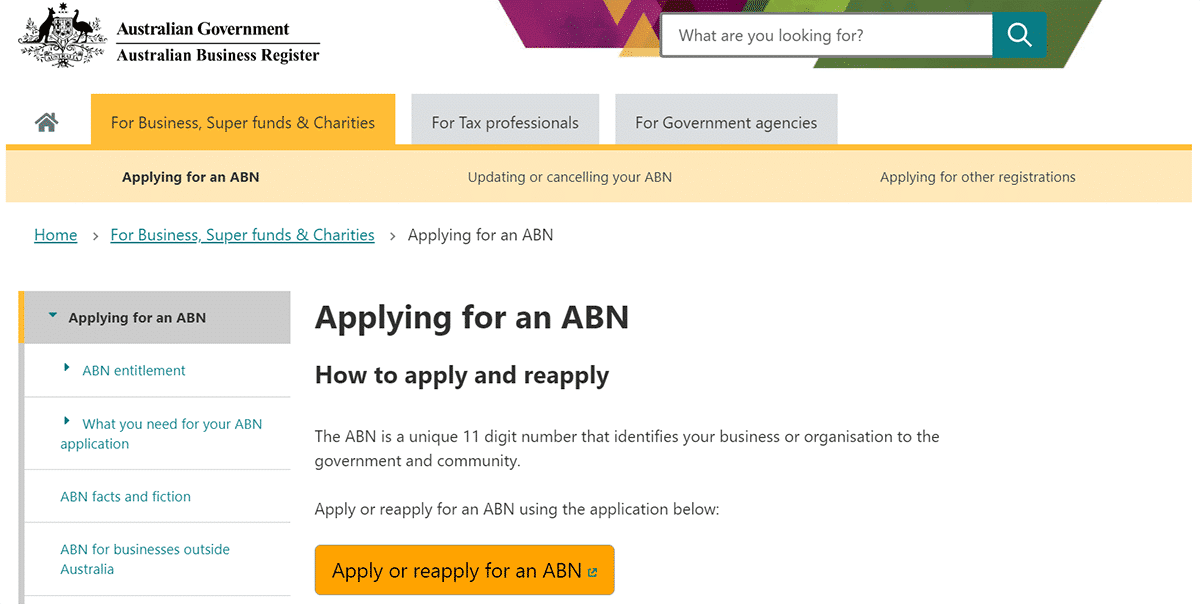

How to Get an ABN?

The ABN application is done online and is completely free. It is done via the Australian government website:

You will need to complete a series of questions to make sure your activity is eligible for an ABN. If it is, you will get your ABN straight away. A digital document will be issued to you, and you will receive a hard copy within 28 days. To complete your application, you will need to provide:

- The nature of your main self-employed activity

- The structure of your company (generally “individual sole trader” if it is just you involved in the business, “partnership” if there is more than one person)

- Your Tax File number (TFN)

- Your contact details (postal address, email, phone number).

How to Update or Cancel your ABN?

You are responsible for updating your ABN contact details. You will need to do this within 28 days of any change in circumstances. Likewise, if your business structure changes, you may need to cancel your ABN and request a new one. If your business has been sold or has gone out of business, you will need to cancel your ABN.

The fastest way to update your information or cancel your ABN is online using the myGovID app.

Tax Obligations with an ABN: What You Need to Know

Declaring Your Income 📅

- Australian Financial Year: Runs from July 1 to June 30.

- Tax Declaration: Must be lodged with the Australian Taxation Office (ATO) between July 1 and October 31.

- Mixed Income? If you worked both as an employee (TFN) and as a freelancer (ABN) during the year, you must declare all income in a single tax return.

Managing Your Taxes as a Freelancer

As a self-employed individual, you receive gross payments from clients, meaning no tax is deducted upfront. It’s your responsibility to set aside a portion of your income to cover your tax obligations.

To ensure you’re prepared:

💰 Estimate your annual income to determine how much tax you will owe.

📊 Identify your tax bracket to understand your tax rate.

📌 Set aside money regularly to avoid financial stress at tax time. A common rule is to save at least 25-30% of your earnings for taxes.

💡 Tip: To avoid surprises, consider making quarterly tax payments to the ATO instead of paying everything at once at the end of the financial year.

Tax statuses and rates (2024 – 2025)

Depending on your situation, different tax rates are possible:

Tax Rates for Residents

You will be considered a tax resident as soon as you have your main residence or live more than 6 months per year in the country at the same address.

| Taxable Salary Class | Tax rate |

|---|---|

| 0 – $18,200 | 0 |

| $18,201 – $45,000 | 16 cents for each $1 over $18,200 |

| $45,001 – $135,000 | $4,288 plus 30 cents for each $1 over $45,000 |

| $135,001 – $190,000 | $31,288 plus 37 cents for each $1 over $135,000 |

| $190,001 and over | $51,638 plus 45 cents for each $1 over $180,000 |

Non-resident Tax Rates

If you are not considered as a tax resident, the tax rate on your salary will be higher.

| Taxable Salary Class | Tax rate |

|---|---|

| 0 – $135,000 | 30 cents for each $1 |

| $135,001 – $190,000 | $40,500 plus 37 cents for each $1 over $135,000 |

| $190,001 and over | $60,850 plus 45 cents for each $1 over $190,000 |

Working Holiday Visa Holder Rates

These rates apply to Working Holiday Visa makers income (visas subclasses 417 (Working Holiday) & 462 (Work and Holiday)).

| Taxable Salary Class | Tax rate |

|---|---|

| 0 – $45,000 | 15% |

| $45,001 – $135,000 | $6,750 plus 30 cents for each $1 over $45,000 |

| $135,001 – $190,000 | $33,750 plus 37 cents for each $1 over $135,000 |

| $190,001 and over | $54,100 plus 45 cents for each $1 over $190,000 |

💡 Backpacker advice: If you plan to stay in Australia for a while, consider putting some money aside for your retirement. Open a superannuation account to deposit money into.

Declare the GST

The GST (Goods and Services Tax) corresponds to VAT in other countries. In Australia, the GST is 10%. As a self-employed person, you will only have to pay GST if your income under ABN is greater than $75,000 per year. If you estimate that you will earn less than $75,000 with your ABN, you do not need to register for GST.

You will be able to register for GST once your ABN has been created. Once registered, you will need to include GST in the price you charge your customers. You will also be able to request reimbursement of the GST on the products or services that you buy for your business.

For more information: GST in Australia: How it works

What Jobs can I do Under an ABN?

Whether it’s a full-time job or just an income supplement, working under an ABN has many advantages and is attracting more and more people. Most often, being self-employed means choosing your own schedules, working at your own pace, working remotely…Many people only see benefits in being a sole trader.

From those looking to start their own small business, to those working in services, to those drawn to the digital nomad life…Having an ABN is an easy way to get started on your own. Some of the most common jobs that use an ABN include:

- cleaning (for individuals or professionals)

- delivery people (Ubereats, Deliveroo…)

- personal consultants or coaches

- graphic design (webdesign, photographer, editor, etc.)

- work on construction sites (ploughing) such as carpenters, plumbers etc.

- home assistance, baby sitters, sports coaches.

Become freelance in Australia

All the regulations for working as a freelancer in Australia. With the best sites, salaries, invoicing, taxes and more.

How to Issue Invoices Under an ABN?

To issue invoices under an ABN in Australia, follow these steps:

- Create an invoice: Use billing software or create an invoice template. The invoice should include:

- Your name or your business name and your ABN.

- The client’s contact details.

- A detailed description of the goods or services provided.

- The total price to be paid (including GST (Goods and Services Tax) if applicable).

- The invoice date and payment terms.

- Include GST if necessary (for incomes over $75,000/year): If you are registered for GST, you must include GST in your invoices. This means an additional 10% on the total amount. Ensure that it is clearly indicated that GST is included.

- Number your invoices: Each invoice should have a unique number to facilitate tracking and management.

- Send the invoice: Provide the invoice to your client via email, mail, or another agreed-upon method.

- Keep records: Keep a copy of all invoices for your accounting and for GST reporting.

- Track payments: Ensure to follow up on received payments and remind clients of late payments.”

This is a basic structure for generating compliant invoices within Australia, incorporating the necessary details for both GST-registered and non-registered businesses.

What is the difference between TFN and ABN?

The TFN (Tax File Number) and ABN (Australian Business Number) are both identification numbers used in Australia, but they have different functions.

The TFN is your Tax File Number. This 9-digit number is unique to each individual and is required to be able to work in Australia. With each new job, you will have to provide it to your employer. It is the Australian Taxation Office (ATO) that issues your TFN. The application is free and can be done online, on the official website. The TFN is used for tax filing, income tax calculation and tax refund

The ABN (Australian Business Number) stands for Australian Business Number. It is essential if you want to start a business in Australia. It is indeed the unique identification number that will distinguish your company once created. The ABN is issued by the Australian Business Register. If you want to be self-employed, you must have a TFN and an ABN.

In summary, the TFN is used to identify individuals to the Australian tax authorities for tax reporting and tax calculation, while the ABN is used to identify businesses to the tax authorities and for business transactions. It is possible to have an ABN without having a TFN if you are not working in Australia, but for a company.

FAQs ABN Australia

Any business conducting commercial activities in Australia, whether for profit or not, must have an ABN. The same applies to individuals wishing to work as freelancers in Australia.

To obtain an ABN, you must register online with the Australian Business Register (ABR) and provide information about your business. The application is done online.

Yes, applying for an ABN is free and done online.

Getting an ABN may take up to 28 business days, but most applications are processed more quickly.

No, there are certain conditions that your business/you must meet to be eligible for an ABN.”

Hey guys,

a little different question. I received my ABN in June 2017 and earned money for like three months or so. I left Australia in September 2017 and since then didnt earn any money. But I didn´t cancel my ABN. Is this going to be problem or does the australian government cancel my ABN by themselves at one point? I hope you can help me out with that question. Thanks in advance,

Robin

Hi Robin,

The tax office gives you three years to have no income with your ABN, then they’ll suspend it for inactivity.

hey there,

I am currently in the same situation but it’s almost impossible for me to cancel my ABN from overseas after having left Australia permanently. I wonder – did your ABN really get suspended for inactivity after 3 years or is it still logged as ‘active’ in the ABN register?

Cheers, Janina

Hi Janina, yes it’s supposed to marked as suspended after a while. Cheers

I earned 4 months worth of wages on an ABN back in 2020 but had to leave Australia due to covid and I never lodged a tax form. I’m due to come back to Australia in October on a tourist visa, will I get stopped at the border for this?

Thanks

Hi Jack,

You don’t need to lodge a tax return or a non-lodgment advice if both of the following apply:

– All of your income was earned as salary or wages while you were a WHM.

– The total of your taxable income for the income year was less than

$37,001 for 2019–20 and earlier income years

$45,001 for 2020–21 and later income years.

Cheers

Hello to our Guide,

is that true and does it still apply for the tax year 2022/23?

I am still unsure about the matter because on the ATO website it says if you have an active ABN that you got income with you have to file a tax return no matter what..

Thank you very much in advance for your help.

Cheers, Janina

Hi Janina, yes you need to do your tax return and include incomes earned with your TFN (as an employee) and your ABN (as a freelance). Cheers

Hello Jack,

I wonder – did you get stopped at the border for not having lodged a tax return back in 2020?

Did someone mention it or did you get in trouble because of it – like having to pay a fine etc.? Oh and were you eben able to obtain the tourist visa in the first place?

I can’t help but be curious.

Thanks in advance,

Janina

Hi Janina, no it shouldnt be an issue – see extract from official website:

You don’t need to lodge a tax return or a non-lodgment advice if both of the following apply:

All of your income was earned as salary or wages while you were a WHM.

The total of your taxable income for the income year was less than

$37,001 for 2019–20 and earlier income years

$45,001 for 2020–21 and later income years.

Hi, I’m coming to Australia on WHV subclass 417 with the intention of applying for ABN and work on my own from my laptop. Is there any 6-month work limitation for ABN holders on WHV?

Hi Matt,

No all good 🙂 Enjoy !

Hi I am on a 417 visa and have to do my three months regional work for second year visa.

Is it true I have to be on tax file for them three months in order to receive pay slips? (I’m currently on abn) if not then what documents must I produce when applying for second year visa?

Thanks

Hi Shane, you must have your TFN too as you needed it to create your ABN. Cheers

Hi

I have a company in the Uk and wish to trade in australia also online and have physical staff

Can I apply on this basis from the Uk ?

Thanks in advance

Hi Andrew, You wont be able to apply for an ABN, you will need to be in Australia. But you can trade in Australia with your UK company. Cheers

Hello,

My boss wants me to get the ABN but after the job here I’m gonna leave Australia so I will only get my money from one person. Is it a bogus-self employment if I do so? And if yes what can happen?

And if i destroy something at work do I liable for the damage?

Thank you

Hi there, if it is only for this job, you should negotiate for your boss you employ you as an employee and not a contractor! Cheers

If the foreign company has applied for ABN three months ago …. Yet didn’t get ABN, what may be the process to raise invoice & can I get the payment? What what shall be the and tax implication??

Hi there,

You should contact the ATO for this – 3 months is way too long. You usually get your ABN straight away or within 28 days. Contact them to follow up your application. Cheers

Want to understand…. any other information needed?

Hey see my other response. Cheers